History doesn’t repeat… it rhymes.

Preface

This series originates from my talk at Devcon V in Osaka on October 10, 2019. While this written format dives much deeper and has additional resources and links to further reading, you can watch the video of said talk here.

Originally this was going to be one long article, but there are a handful of different concepts that are covered and it made more sense to split this up into three parts.

I want to make something clear: I very much love crypto and this space. However, I think we should be having this conversation publicly, especially if we want to achieve the goals we set out to achieve. The most substantial growth will stem from difficult and honest discourse.

I am by no means an expert on any of these subjects. Find me on Twitter and challenge my thinking. 💖

This is Part 1.

Background

The internet enabled the instant, borderless, permission-less transfer of data and information. Blockchains enable the same for value.

Value is not just money. It’s any form of digital asset: money, assets, property, obligations, contracts, and more. Jeremy Allaire of Circle has talked about “The Tokenization of Everything” extensively if you want to learn more about this concept.

Blockchains are the next logical step in our technological revolution. The way we currently transfer anything of value today will seem just as archaic as communicating only via written letter or only having access to the books in the local library.

The evolution is greater than that though. On a recent episode of the a16z podcast, Marc Andreessen talked about how the internet suffered from one ‘original sin’: browsers lacked a buy button. He hypothesizes that if there had been one, we may not have gone down the road we did with everything relying on advertising. This need for financial sustainability was ultimately responsible for the invasive collection of data, misalignment of incentives, invasions of privacy, and asymmetry of information that dominates the modern landscape.

If crypto was around in 1992/1993, it could have allowed a superior economic model to thrive.

Throw some humans in the mix though…

Blockchains are still built by people, though. New innovations in technology don’t overcome the human or social problems — these innovations are merely a tool that we can use, for better and for worse.

Ultimately, we can change the tools we use and the technology that is available, but we cannot change human nature.

And this is important to understand as humans are quite unique. We have desires that can never be truly satisfied. The moment we achieve one thing, we move the goalpost and reach out for the next.

We also have this deep desire to possess things. We may eat until we are full, live in a safe environment and have a safe home, yet still wish to have more.

And, unfortunately, we are generally selfish. We will gladly impoverish others in order to improve our situation or acquire more. This trait manifests in greed and vanity and, in the crypto space, ICOs, Ponzi schemes, scammers, phishers, and shouters on #CryptoTwitter.

While there are many similarities between the early web and the early blockchain ecosystems, history won’t repeat itself exactly. But, it will rhyme.

We should look back at the evolution of the internet for insights about what the future holds for crypto. In doing so, we can learn from the mistakes of our predecessors and refrain from going down a similar, dark path.

It’s quite telling that some of the similarities we share have disappeared over the years. For example, small, marginal players used to thrive. Andreessen graduated with his bachelor’s degree in computer science in December 1993, Mosiac/Netscape IPO’d in 1995, and he was on the cover of Time Magazine in 1996. Today, the tech industry is dominated by large corporations, and “thriving” means getting your startup acquired by one of them.

It’s also telling how quickly things can change. Like the blockchain, setting up the internet required 50 steps, a helpful friend, and a trip to the bookstore. Those born today don’t even realize that the internet has wires.

It’s frightening to see how quickly the culture shifted once the web started to gain traction. Originally, it was loosely organized with no one in charge. Those early adopters and builders believed that the technology could enhance personal freedom and remove power from centralized entities. Just as the web was partially a response to the encroachment of the US government and the abuse of power executed by other nation-states, Bitcoin was partially a response to the government, the banking system, and new guard which rules our lives (Google, Apple, Facebook, Amazon.)

As we push forward, it’s necessary to be mindful of what we are building and that we are still shaping the future that we want.

As we know now, the internet didn’t just connect people, give people access to knowledge, and enlighten us all. For all the good it has done, it has also done as much harm.

The web has enabled more government abuse and surveillance by nation-states. It then enabled corporations like Google and Facebook to exploit us for profit.

It has created an entirely new business model that is less about advertisements and more about the extraction, collection, and capitalization of our information and behavior.

It has created more information asymmetry, which only further degrades our personal freedoms and consolidates power to those who control the most amount of information about us.

And, unfortunately, the creators of this new system optimistically patted each other on the back for “connecting the world” and “indexing the world,” and didn’t seem to mind that they were well down a path that would do the things they originally set out to fight against.

Hard Questions

Question: Why won’t crypto turn out the same way?Answer: It will.

The blockchain, at its core, is a public ledger.

We are optimistic about the potential use cases of its public nature, like the public transparency and accountability.

However, anyone — not just one company building a moat around its castle — can access and analyze everyone’s entire financial history. All of our actions are pseudonymous, not anonymous, and our identity is further compromised each time we make a transaction and use products and services that rely on the existing systems, whether those are KYC systems, banking systems, or internet systems (AWS, DNS, etc.).

With chain analysis, it is trivial to connect accounts to account holders, building a comprehensive financial overview of you that includes every transaction, every service you interact with, every vendor you pay, every product you use, and every news site you subscribe to. This level of insight doesn’t exist in the current system.

The credit rating companies can get your credit card balances, but not your transactions. Your bank has some of your transactions, your credit card company has other transactions, and your student loans are held by a completely separate party.

A single interaction on the blockchain has the ability to connect one of your addresses to your online identity or real-world identity. Because the blockchain is immutable, there is no way to “unlink” this information.

The level of education that is needed to prevent the exploitation of this data is terrifying. While the OGs in this ecosystem may consider their past transactions before making a new transaction, even they may not consider that any future transactions could also dissolve their pseudonymity.

For example…

I choose to use a mixer in order to prevent an untrustworthy vendor from seeing my transaction history. I take some of my coins, send it through a mixer to a fresh address, and then pay the vendor. All good, right? The vendor doesn’t know anything about me.Well, what happens in a month when I sweep the leftover mixed funds to another address? No matter how much time has passed or how careful I was when I initially made the purchase, the vendor, and anyone else who is looking, can glean information about me via these “future” transactions.

If I don’t live in a constant state of paranoia or use products that protect me automatically, this will happen time and time again. The original context of protecting my identity is no longer at the top of my mind as time goes on.

Question: Why would crypto allow the next Mark Zuckerberg to gain the same power, knowing what we know now about Facebook’s history?Answers: 1) Money? 2) We already are with Libra? 3) Because we don’t have the power to “allow” or “disallow” things of such nature.

The only real way to protect ourselves and our future selves in to create a system that is trustless on a deeper level. You can trust the contract won’t do X, so long as you can see the code and understand it. That should apply, and be accessible, at scale. You shouldn’t trust that a company won’t sell your data, you should know that they can’t sell your data because they don’t have the ability to see your data.

No one should be able to use our behavioral insights for profit, directly or indirectly, especially when that data is the combination of all our financial information, social information, governance information, etc. This is a more invasive model than Facebook currently has, but, if we aren’t careful, a model that Facebook…sorry….“The Libra Foundation” could already be working toward implementing.

Yet instead of talking about this, we laugh and place bets on whether Libra will actually launch or not. It’s easier to pretend everything is fine. It does not make everything fine.

Question: Why the fuck does it matter?Answer: Because intentions matter.

When most of us got into this space, we did so with the hope that we could be part of building a better future. We wanted to be part of the revolution. We wanted to fight against the old guard (gov’t) and the new guard (Facebook). We wanted to build something where the potential was infinite.

However, there is a real possibility that we are building the same system we currently have. There is also a real possibility that this new system is actually worse than the system we currently have.

And, yes, blah blah blah, we can argue the semantics of “worse” all day. And, yes, there are a ton of positives that come with these negatives. But let’s be real for a second.

Blockchain technology is far more interesting from a technical perspective than from a social perspective. It is only interesting from a social perspective in terms of what it could enable. But just because it could enable these possibilities, doesn’t mean it is enabling them or will enable them.

When it comes to the human issues, the people issues, the social issues, the blockchain is just a tool that we can use. It’s how we, the people, use that tool which will determine whether we ultimately build something net-positive or net-negative.

With higher-level dapps and systems starting to be built, will this technology be used to improve the human condition or exploit humans?

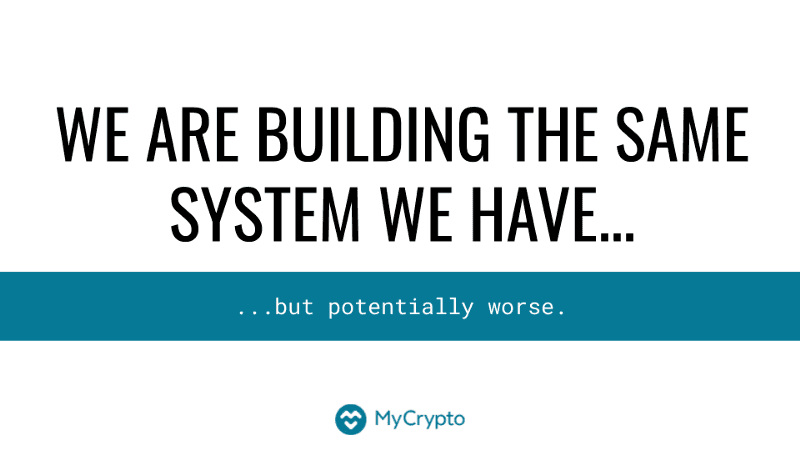

If we look at where the majority of the action is taking place currently, we see that we are clearly on a road that has more centralization, more intermediaries, more risk, and more information asymmetry.

If we continue down this path and increasingly consolidate where assets are held and where the risk lies, it will ultimately result in systemic failure. The more assets that the custodians accrue, the more power these parties have. And whenever you have an asymmetry of power, you will have an abuse of that power.

These abuses of power can even be executed with positive intentions. While the DAO was not a centralized exchange (and I disagree with the notion that Vitalik is some almighty god who abused his power to recoup his personal investment into the DAO), the situation shows just how powerful the fear of the unknown is. When given the choice between a scary, unknown, everyone-loses-their-money path and an everything-will-be-okay path, people will gleefully skip down that happy path.

This became even more obvious when Binance was hacked. Suddenly people were willing to sacrifice their philosophies in order to roll back the chain and help Binance recoup the 7,000 BTC / $40M dollars that was stolen. Let’s stop right there for a moment.

Relative to other hacks, this is one of the least threatening losses in the space:

╔═════════════════╦════════════════╦════════════════╦══════════════╗

║ BINANCE ║ THE DAO ║ MT GOX ║ BITFINEX ║

║ 7,000 BTC ║ 12,700,000 ETH ║ 650,000 BTC ║ 120,000 BTC ║

║ $40M USD ║ $100M USD ║ $450M+ ║ $72M USD ║

║ 0.03% OF BTC ║ 15% OF ETH ║ 6% OF BTC ║ 0.75% OF BTC ║ ║ FROM EXCHANGE ║ FROM PEOPLE ║ FROM EXCHANGE ║ ON HAND ║ ║ FROM PEOPLE ║ FROM EXCHANGE ║ ON HAND ║ ║

║ THAT HAD $100M- ║ (11,000+ ║ THAT WAS DOING ║ = TO 36% OF ║

║ $200M IN PROFIT ║ ACCOUNTS) ║ 70% OF ALL BTC ║ USER ║

║ THAT QUARTER ║ ║ TRANSACTIONS ║ HOLDINGS ║

╚═════════════════╩════════════════╩════════════════╩══════════════╝I hate to use the word “only” but… we’re only talking about 7,000 BTC aka $40M USD, which is about 0.03% of all BTC in existence. It was stolen from Binance, one of the fastest-growing and most profitable players in the space, who likely made between $100M and $200M in profit that quarter.

If that scope can start such a conversation, I have no doubt that a new loss occurring today with the same scope as the DAO or Mt. Gox would spur a much more persistent dialogue.

If there is no accountability, there is no honesty.

If we are not honest about what we are trying to achieve, what we are actually achieving, and how we are going about achieving it, we don’t have accountability to each other or ourselves.

We need to stop patting ourselves on the back each time we overcome a tiny regulatory or design hurdle, especially when we sacrificed our values in order to do so.

Death by a thousand cuts is still death. It doesn’t matter if we immediately have our heads chopped off or we slowly degrade over time, the end result will be the same.

The best slaves are the ones who believe they are free. So, sure, we don’t blow up glamorously and instantly. But we also may not realize that we are on this fatal path until it is far too late.

We may already be building a big, beautiful, nicely painted Lego castle.

But if that Lego castle is made shit, it will eventually erode and our shit will become the foundation of the future that we live in, our children live in, and our grandchildren live in.

And we will have to live with ourselves, knowing that we helped create that future.

Stay tuned for Part 2 in the next week or so.

–Taylor 💖

References & Further Reading

- Taylor Monahan @ Devcon 5 // Video version of this article

- Tokenization of Everything

- a16z Podcast: From the Internet’s Past to the Future of Crypto

- https://twitter.com/Melt_Dem/status/1177624330278199297

- For tech giants, a cautionary tale from 19th century railroads on the limits of competition

- Cryptocurrency Might be a Path to Authoritarianism

- LessWrong: What Failure Looks Like

- Attacked from Within

- The Reverse of Stupidity is not Intelligence

- The Four Desires Driving All Human Behavior: Bertrand Russell’s Magnificent Nobel Prize Acceptance Speech

Talk To Us & Share Your Thoughts