Everything you need to know about staking in Ethereum 2.0

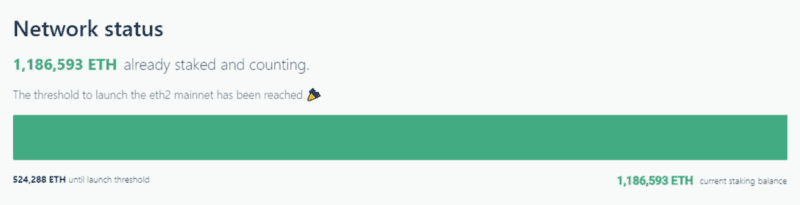

November 4th saw the deployment of the staking deposit contract, which required a minimum of 524,288 ETH for a successful launch of the first phase of Eth2 on December 1st. This threshold was met, and the launch (genesis) of the beacon chain went smoothly. More than 1,000,000 ETH has since been deposited for staking.

We previously published a glance of how Proof of Stake works in our ETH2.0: Everything You Need to Know article, which we highly recommend you read first, that covers a wide range of topics within Eth2 and should give you a good foundation for what we detail here.

With so much ETH already being staked at this time, you might be inclined to get started with staking as well. However, is staking at this moment in time a good idea? And what are the risks involved? The following is included in this article:

- What is staking?

- Should I be staking?

- What are the risks, and how can I get started?

What is staking?

Right now, Ethereum works with a proof-of-work (PoW) consensus mechanism, just like many other blockchains, such as Bitcoin. In this system, miners perform difficult mathematical tasks in order to form blocks and mine transactions.

This process is insanely resource-intensive and consumes an enormous amount of electricity. Proof of stake (PoS) tries to solve these issues, aiming to provide even more decentralization than proof of work is currently able to achieve.

With staking, so-called validators keep an eye on the network and propose new blocks in which transactions will be included. These validators work together to keep the network as secure as possible, and any bad actors will be penalized by having their stake “slashed.” Slashing is a mechanism by which part of someone’s stake will be removed if they deliberately try to attack the network, and in the worst case, even one’s full stake (up to 32 ETH) can be slashed.

For more information regarding the differences between PoW and PoS, and the various other new exciting things that are introduced with Eth2, I highly recommend you to read our ETH2.0: Everything You Need to Know primer.

What is the genesis event?

The genesis event occurred on December 1st, and refers to the creation of the first (genesis) block of the beacon chain. This means that the first phase of Eth2 succeeded and that the validators can propose new beacon chain blocks.

These validator clients will be working on keeping the beacon chain running smoothly. Now usually, the beacon chain is there to keep track of all the shard chains (see primer) in the network, but these are not yet implemented in the current phase of Eth2 and are expected to launch at a later stage.

So the validators maintain the beacon chain, but what is its purpose right now? At this time, not a whole lot. The beacon chain itself doesn’t actually do anything for the time being, but it’s a crucial foundation for the rest of Eth2 updates to come. If this foundation proves stable and functions well, future upgrades will have a much bigger chance of succeeding.

Should I be staking?

Withdrawing your staked ETH and staking rewards will not be possible until Ethereum has fully transitioned to proof of stake.

This might take until 2021 or 2022, or even later than is currently anticipated. Withdrawing will only be possible once future upgrades are deployed to the network during an upgrade called “docking.” To allow the Ethereum network to “dock,” firstly both phase 0 and phase 1 will need to be deployed, which will allow beacon chains and sharding chains to operate with each other. Phase 0 has already just launched, and phase 1 is expected to be launched in 2021.

Docking is also known as phase 1.5, and only then will the Ethereum network as we know it be able to transition to a full proof-of-stake system, managed fully by the validators, beacon chains, and sharding chains. The Ethereum network as we know it today will become its own shard within this new system.

You will have to make the decision for yourself whether you are in a comfortable position to stake your Ether for this amount of time, especially when it’s still unclear when in the future you will be able to withdraw.

Can I make money from staking?

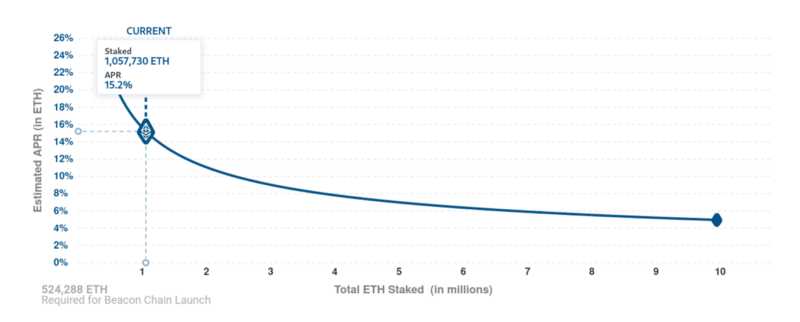

By participating as a validator, you will be able to receive awards for your efforts, just like with mining. The amount of ETH that you can expect to earn will depend on the amount of ETH that is staked in total. The less ETH that is staked by the ecosystem as a whole, the higher the rewards for individual stakers will be on a per-year basis, and vice versa.

The Eth2 Launch Pad has a nifty tool that allows you to see what kind of returns you can expect based on how much ETH is staked in total.

For example, if 1,000,000 ETH is locked up for staking, you can expect a yearly return of 15.7%. Keep in mind that even though you will be able to receive rewards, you will not be able to withdraw these until Ethereum has fully transitioned to proof of stake.

The benefit of the staking mechanism, as opposed to mining, is that you are not required to invest in expensive hardware and high electricity costs. Anyone could become a validator as long as they have the minimum amount of required ETH to stake and can keep their validator client up and running.

What are the risks?

First of all, you need to keep in mind that your ETH will be locked up, therefore illiquid, for an indefinite amount of time.

Second of all, staking requires you to maintain a bit of infrastructure, namely your validator client. Stakers can face being penalized if they aren’t able to keep their validator client up and running consistently enough. You might have to try and keep your client running for years, which is not a small commitment.

If your client is offline, you will lose roughly the amount of money that you would’ve been able to earn in that timeframe if the client was online. This means that if you were set to earn X amount of ETH in a set period, you would instead be penalized roughly that amount instead.

You can avoid this by joining a staking pool, in which the validator client and infrastructure will be maintained for you by someone else. However, this brings other risks along with it, as you might have to give up custody of your assets, so another party can handle the staking process for you. If the staking provider is not to be trusted or gets hacked, you might end up losing your funds, as we’ve seen countless times before with cryptocurrency exchanges.

Some popular exchanges are already introducing the possibility of staking ETH on their platforms, such as Coinbase, Kraken, and Binance.

Additional, indirect risks with ETH2 are the potential for new scams to pop up. When the ETH2 contract deposit address was revealed, a handful of mimics appeared shortly thereafter.

There will be many more ETH2-related scams that appear as the development progresses and releases occur, and you’ll need to look out for those. The most important thing you can do is always verify everything at the source.

How can I stake?

To get started with staking, you will firstly need 32 ETH. This is not a small amount, and is equal to roughly $19,000 at the time of publishing this article.

However, you can still participate with fewer funds by contributing a smaller stake to exchanges that have staking functionality, or by joining a staking pool. You can find a list of these pools here, but do keep in mind that you have to do your own due diligence to find whichever pool works best for you.

If you would like to stake 32 ETH, you can head over to launchpad.ethereum.org to start the staking process. This will require you to run an Eth2 validator client, such as Prysm, Lighthouse, Nimbus, or Teku.

Conclusion

The decision of whether to stake or not isn’t an easy choice to make at this time, and there are lots of different factors to keep in mind when choosing to do so. If you are comfortable with not being able to access your stake for most likely years, and you are confident that you can keep your validator client running for all that time, you might be able to earn a decent profit with the staking rewards.

It’s not an easy choice for now, and I would highly recommend you to continue reading about this topic to make an informed decision. You can find a great amount of information on the official Ethereum website. The knowledge base maintained by beaconcha.in is also a great resource, albeit a bit more technical.

To get started with staking, you can visit Ethereum’s staking launch pad.