The migration from Sai to Dai is confusing. We’re here to help.

TL;DR: If you hold Dai in any form, you need to take action. Sorry. Keep reading.

The Dai that you currently know and love has been split into Single Collateral Dai (SCD or Sai) and Multi-Collateral Dai (MCD or Dai). Eventually, Sai will be deprecated, so you need to take action before that time. READ THIS AND TAKE ACTION WHILE YOU STILL CAN.

If you have Dai in a wallet that you hold the private keys to and are able to access via an interface like MyCrypto, follow these steps:

If you have Dai in a wallet that you DO NOT hold the private keys to (like a centralized exchange or wallet), you can check with these services for their specific instructions, or transfer the Dai to a wallet you control the private key to, and upgrade it yourself via the steps directly above this.

FOR ALL OTHER SCENARIOS RELATED TO DAI, Maker has published a developer guide, including how to manage this transition if you’re:

- A custodial or non-custodial provider of wallets

- A centralized or decentralized exchange

- A CDP holder or CDP provider

- And basically every other possible scenario

If you’re a Compound user or have a large CDP, read this.

At some point, Maker will deprecate SCD (and your Sai tokens) by calling for an Emergency Shutdown vote. This will likely not happen right away, but there’s no set date for it so it’s best to take action and migrate from Sai to Dai as soon as possible.

Let’s Dive A Bit Deeper

Dai has perhaps been the staple stable coin of the Ethereum community. It has earned trust on a level that that none of the other USD-tethered counterparts have, and has enjoyed a significant track record of usability — whether as a method of payment for work by various blockchain companies with international staff, or in the form of xDai, which was used by EthDenver’s Burner Wallet by Austin Griffith. Indeed, earlier this month, Dai hit the market cap of 100 million that was set in July of 2018, signaling that the token is thriving.

Dai operates on the principle that users stake Ether in order to borrow Dai, which is pegged to the value of the US dollar and therefore does not suffer from the volatility that most crypto-assets do. Over the past year, the Maker Foundation has been ramping up to launch Multi-Collateral Dai (MCD), which will enable users to stake additional crypto-assets other than Ether.

At least to start, it appears that only other Ethereum-based assets (ETH and ERC-20 tokens) are being considered as forms of collateral. On August 19, Maker Token Voters approved of the following list to be evaluated by Maker’s Risk Team: ETH, REP, BAT, 0x, DGD, OMG, and GNT.

Now, CDPs, or Collateralized Debt Positions, are the smart contracts that one can use to stake Ether (and now the other included assets) to obtain Dai and vice versa. To make matters more confusing, also beginning November 18, Maker will begin referring to CDPs as “Vaults” and wants everyone to get on board with the terminology update. Maker explained that this change is an attempt to make the concept easier to understand for a wider audience of new users. Apparently, many users reported being confused by the term “collateralized,” which has historically been associated with traditional financial products, and “some people are already using the term ‘CDP’ to mean everything a user holds in the Maker Protocol, while others are using it to mean each type of collateral deposited.”

Vaults make it so that new Dai can only be minted when another asset is locked up as collateral and old Dai is burned when exchanged back through the contract to recover the asset. This control over supply ensures the stability of Dai’s value. As a safety precaution, in the event of a catastrophic situation in which the value of Ether plummets below the collateralization ratio so quickly that the system does not have a chance to right itself, an Emergency Shutdown (formerly known as a Global Settlement) will be triggered. In this case, “the entire system freezes and all holders of Dai and CDPs are returned the underlying collateral.”

A few things to keep in mind:

- Only one collateral type can be associated with a vault. One cannot lock up $5 worth of ETH and $5 worth of BAT in the same vault and pull out 10 Dai.

- As with Sai, in order to retrieve an asset that has been locked in a vault, one must pay back the amount of Dai that was previously generated as well as a Stability Fee.

- Once a vault is emptied, it doesn’t disappear. The vacant contract will sit idle on the blockchain until it is used again.

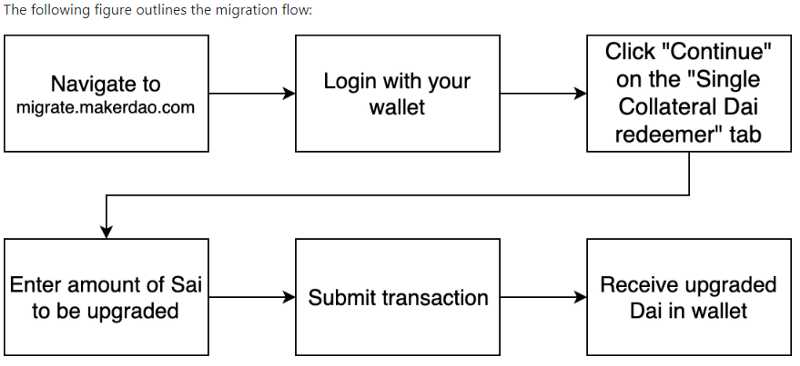

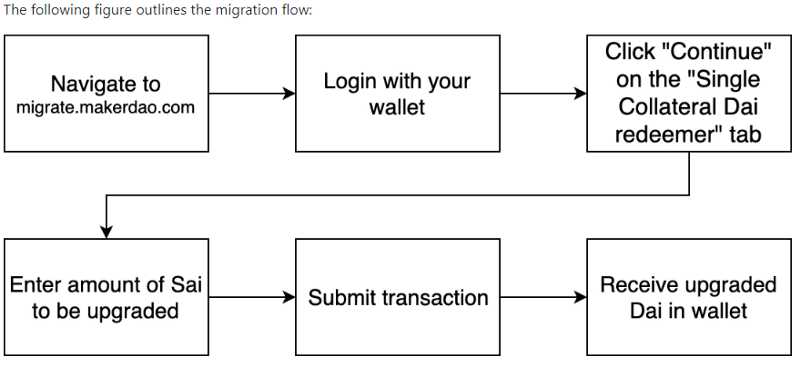

Maker moved MCD from the Kovan testnet to the main Ethereum network on November 18, 2019, at 4:00pm UTC, and subsequently launched its Migration Portal, which allows users to upgrade their Sai to MCD at a one-to-one rate, as well as upgrade their Vaults. The Migration Portal will guide users who control their private keys through the following steps:

Users who have entrusted their private keys to a third party, such as an exchange, custodial wallet, or dapp will have to either consult the third party for instructions or withdraw their Sai and regain custody.

Instructions on how to upgrade CDPs to Vaults can be found here as well as by visiting the Migration Portal.

The plan is to allow MCD time to get its footing through a multi-event process and eventually sunset Sai. According to Maker’s blog, “Maker Governance will determine the timing of the shutdown; no one can predict when it will happen.” While the grace period does not yet have an expiration date, please pay attention to further announcements because any users still holding Sai at that time will be subject to an Emergency Shutdown.

Remember earlier when we mentioned the Emergency Shutdown failsafe? This process is also intended to be used as part of significant technical upgrades (like the one that’s happening right now). Anyone still holding Sai after the still ambiguous grace period ends are meant to experience the following process: The system will lock, freezing the Dai Savings rate and reference prices, as well as preventing further creation of Sai. All pending collateral auctions are given the chance to settle, and then the system is able to “calculate the distribution of collateral to remaining Dai in circulation.” Then, all Sai holders will have to manually redeem the tokens.

As time goes on, the term “multi-collateral Dai” is expected to become obsolete and most people will just call this new manifestation of the token as simply “Dai.” Please note that some publications are pushing for MCD to immediately only be referred to as Dai, but common vernacular can be a tricky thing to force, particularly within crypto-communities.

According to Maker’s upgrade timeline, several exchanges committed to changing the token name from Single-Collateral Dai to Sai on November 18, including Wyre, Bitcoin Suisse, Bittrex, Kyber, Bamboo Relay, Bitfinex, DeversiFi, Coindirect, GO.exchange, and dYdX. Over the next few weeks, these exchanges will update their trading pairs and eventually de-list Sai. However, “Coinbase and Kraken will upgrade to MCD but will not change Single-Collateral Dai to Sai. Once upgraded, they will only support Dai. Accordingly, please pay extra attention to which token you are dealing with on Coinbase or Kraken.”

It appears that the average user will need to worry about two things for the time being:

- Upgrading their Dai and Vaults through the Migration Portal

- Making extra sure that all applicable parties in a given situation know whether they’re dealing with Sai or MCD, especially when it comes to exchanges.

A more comprehensive outline of what different kinds of Dai-using entities (e.g., non-custodial wallets, lending protocols, Dapps, etc.) need to know can be found here.

If you have further questions or run into any snags, Maker has invited anyone to reach out on the Maker Forum.

Resources

- https://blog.makerdao.com/multi-collateral-dai-is-live/

- https://medium.com/mycrypto/what-is-dai-and-how-does-it-work-742d09ba25d6

- https://migrate.makerdao.com/

- https://blog.makerdao.com/looking-ahead-how-to-upgrade-to-multi-collateral-dai/

- https://github.com/makerdao/community/blob/master/faqs/emergency-shutdown.md

- https://github.com/makerdao/developerguides/blob/master/mcd/upgrading-to-multi-collateral-dai/upgrading-to-multi-collateral-dai.md#sections

- https://medium.com/instadapp/mcd-migration-70782c9e6730

- https://medium.com/cryptolinks/maker-for-dummies-a-plain-english-explanation-of-the-dai-stablecoin-e4481d79b90

- https://blog.makerdao.com/single-collateral-dai-to-multi-collateral-dai-upgrade-timeline-and-actions/

- https://forum.makerdao.com/