NFTs have been dominating the cryptocurrency market for what feels like the entirety of 2021 in a way that sometimes gives off strong 2017 vibes. Back then, traders were trying to hop on every new ICO to make sure they didn’t miss out, and it's the same today with NFT drops - the FOMO is real.

What doesn’t help is that a handful of NFT projects have yielded more than 100x profits, causing everyone in the space to dive into every new project. This results in a whole lot of transactions all at similar times, which means congestion, bottlenecks, and gas prices going through the roof. At these times, it’s nearly impossible to broadcast a transaction without breaking the bank.

These are the gas wars.

OpenSea’s Growth

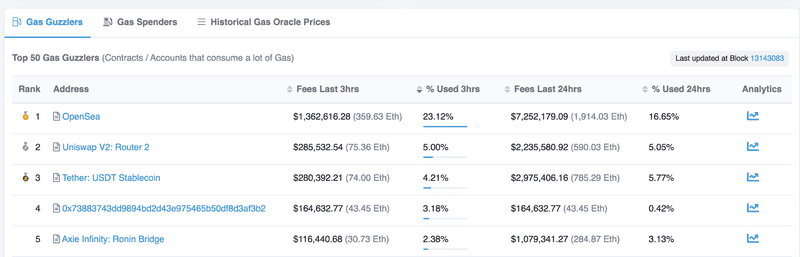

NFTs are here and they’re loud. OpenSea is at the forefront of this growth - nearly 98% of all NFT sales go through the platform. At any given time, it seems OpenSea is responsible for a significant portion of the entire Ethereum blockchain’s fees.

Gas has always been a major topic within Ethereum - just take a look at the history of Ethereum’s block size and block gas limit - but until recently, NFTs weren’t often the source of the discussion (aside from a few key occurrences, like the CryptoKitties launch in late 2017).

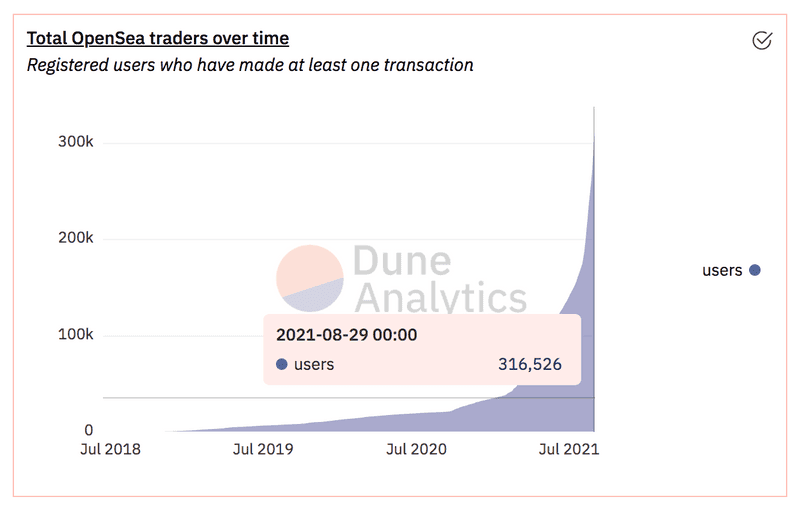

On August 29th, 2020, OpenSea had only 21,662 users who had made at least one transaction. A year later, on August 29th, 2021, that number had increased by more than 10x - OpenSea had grown to over 300,000 users who had made at least one transaction.

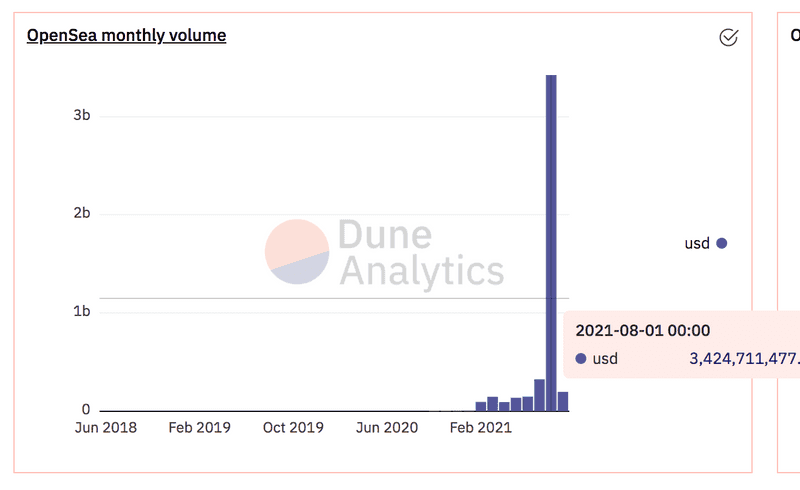

Within the same time period, they went from having roughly $900,000 in monthly volume to a whopping $3.2 Billion. Growth like this has helped the Ethereum and NFT space gain further adoption, but on the other hand, this has led to individuals fighting over NFTs in the form of gas wars.

What is a Gas War

A gas war is a term to describe a ridiculous surge in gas price - everyone is trying to get transactions confirmed within a small window of time, which encourages users to set their gas prices higher and higher and higher, thereby raising the required gwei beyond reasonable expectations.

This problem is compounded when whales get involved in an NFT launch. Many average users can get priced out quickly if the gas price goes too high, but whales may not be affected in that same manner. Sometimes they’ll push the gas upwards to 2000-3000 gwei to be able to secure as many NFTs as they would like. This immediately pushes up the average transaction fee not only for everyone involved in the NFT drop, but also for anyone trying to send a transaction anywhere on the Ethereum blockchain. These gas wars see massive spikes in gas and they are generally short-lived, but anyone trying to complete a transaction during this time will get crushed.

A good example of this was during the StonerCats NFT drop that occurred recently. The gas prices seen during this launch were so high that many individuals lost multiple ETH in fees alone... and some didn’t even receive a StonerCat.

lmao someone just paid 5.8 ETH (and used up 20% of a block in gas) for a failed tx trying to mint 20 stoner cats https://t.co/JfvRtiGkm9

— jimmy (@jimmyjames198) July 27, 2021

Nearly 350 ETH was lost in failed transactions during this launch, and while many missed out on these NFTs, the ones that paid the expensive gas prices were able to secure 1, 2, or even 100 NFT’s. Those that won the gas war were able to flip the newly-received NFTs at a higher price than the initial drop and gain good returns immediately.

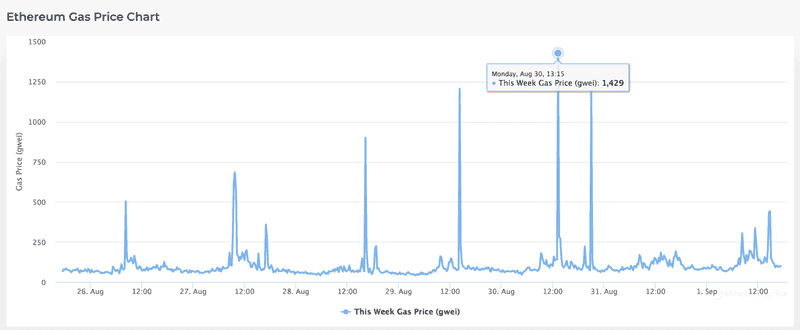

This is the Ethereum Gas Price chart from the week of August 26th, 2021. See those spikes? Those are NFT drops.

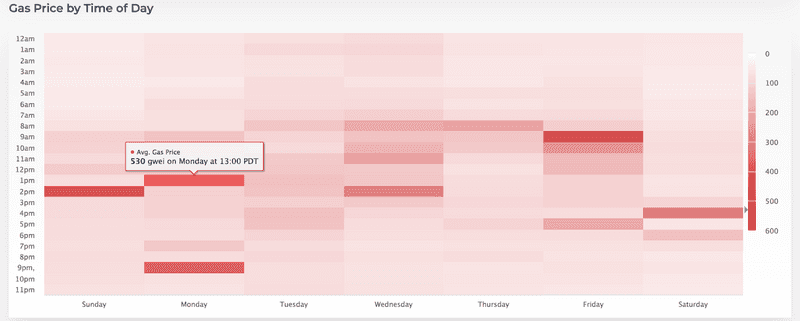

A similar chart shows which times of day have higher gas prices on the Ethereum Network.

What can these tell us? Well, if you need to do something on the Ethereum blockchain that isn’t minting an NFT, you should definitely avoid days where over-hyped NFT drops are occurring, and probably try to avoid the hours of 9-5 (Pacific Standard Time). If you need help monitoring gas prices, check out BlockNative’s new Gas Estimator extension or monitor the gas prices on ETH Gas Station.

Solutions to Gas Wars

Simply put, it’s not feasible for these gas wars to continue long term. It’s unsustainable and alienates people who cannot afford to pay exorbitant gas fees. But how can we solve this?

To reduce the impact of timely NFT drops and avoid the FOMO madness, a few ideas have come to light. Some are still in the research phase, and some have already been implemented in some fashion:

- Standard Reservation: A method where people reserve a spot ahead of time to avoid a rush during the minting phase. Additionally, this would also set limits on how many NFTs each individual can mint.

- Early Supporter Rewards: If you were one of the first 1000 in a Discord or first to follow the project and were an OG, you could be rewarded for your support. A good example of this is Nifty Island, who have rewarded early adopters of the project with exclusive NFTs and exclusive mint opportunities.

- Stealth Drops: A project may have a release drop day, but not a set time. They have everyone preparing to be ready and then drop it without people “lining up at the door.” It’s not a perfect system because as soon as word gets out that the minting has begun, the gas will likely spike regardless, though perhaps less.

- Lottery: Simple and easy. NBA Top Shot has been utilizing this method for quite some time and it has been much fairer for the wait.

- Mint Passes: These are tokens that can be bought and burnt for an NFT during a future drop. It may be difficult to find a Mint Pass for a project, but once it is in your collection, you’re good to go - you have free access to mint within a large timeframe without worrying about fighting in a gas war.

Gas wars are no joke and add a lot of unnecessary congestion to Ethereum. However, it’s still early for NFTs and there’s room to grow and improve the release processes for new projects. The community will hopefully come up with some long-term solutions for fairer and easier NFT launches, but for now, it’s still the Wild West.