The difference between custodial and non-custodial financial solutions that use blockchain technology.

A Custodial Solution

For hundreds of years, humans in the most developed parts of the world have relied on third parties to safely store their assets. Institutions like banks hold their customers’ cash and other valuables and, in return, they receive compensation in one form or another. If you think about it, this arrangement seems counter-intuitive.

Why would one willingly give up proximity and unlimited access to the things they value and pay for that inconvenience?

For the individual, the answer is primarily: security. Over time, the human population at large has become more and more wealthy, and as individuals accumulated a surplus of assets, they needed to choose where to hold them for safekeeping. Many turned to banks to avoid the risks of theft, fires, and other damage that keeping valuables in one’s own home presented and, in turn, banks and municipalities began offering the added comfort of insuring these valuables.

Banks are an example of a custodial financial solution, which is an organization that has been given authority over, and thus control over, another party’s assets. Yes, they may offer a certain level of security from loss, but there are trade-offs.

Trade-off #1: Loss of control

Ultimately, if someone else has possession of your property, they control it. This includes banks, which have been known to seize their customers’ funds by order of state actors, among other reasons. Here is a particularly alarming incident involving Bank of Cyprus in 2013. Even if not participating in straight out theft, banks dictate how much you can spend and how often you can spend your assets, limiting your access to your own property.

Trade-off #2: Personal information made public

For security reasons, banks need to verify the identity of each of their customers. They do this by collecting a considerable amount of personal information, such as address, identity number, photo, birth date, etc., and they store this information on their servers. The problem is that hackers are drawn to large stores of data; such information is valuable to fraudsters looking to steal identities for financial gain. The more custodial organizations we give our personal information to, the more likely it is to fall into the hands of bad actors.

Trade-off #3: Cost

It costs money for custodial organizations like banks to provide their services. From buildings and employees to physical and digital security systems, infrastructure is expensive, and those costs are passed down to their customers.

Trade-off #4: Access in developing areas of the world

Not every area of the globe has the infrastructure needed to provide banking services to its residents. This affects approximately 2 billion people globally, most of whom live in the developing world. Over 30% are from India and China alone.

Trade-off #5: Corruption

As the quote goes, “Power tends to corrupt and absolute power corrupts absolutely.” As financial systems have grown, so has their power. Today, governments and banks are so closely intertwined that they influence every facet of society. Unfortunately for you, the individual, banks rarely use their influence to benefit you, as there is little incentive to do so.

For all the above reasons and more, humans would benefit from a secure way of personally holding their own assets. Through blockchain technology, that is now possible.

Enter Blockchain Technology

A blockchain is a distributed ledger; think of it like a public spreadsheet that exists on a ton of different computers simultaneously. Every time there is a change or addition to this “spreadsheet,” it updates all the spreadsheets on all the computers simultaneously. Information, like details about a transaction, is not stored in one place with one entity in control of it, but stored everywhere there is a copy. Additionally, anyone who chooses to access this “spreadsheet” or store a copy of it on their personal computer can do so.

So, if a person uses a blockchain to send a crypto-asset like ETH to another person anywhere in the world, that transaction can be verified by anyone and everyone who has a copy of the blockchain. No bank is required to process that payment.

Compare that to what would happen if you tried to send digital cash, like USD or EUR, from your account to someone else’s. Both the sender’s and receiver’s banks would need to individually verify that payment themselves, which adds time cost, financial cost, and opportunity for costly mistakes to be made.

These two examples, bank vs. blockchain, illustrate a key operation both perform, but in vastly different ways. That operation is payment processing. The bank processes payments (verifying both accounts and that the sender has enough funds to send before executing the transaction) in a centralized way, ensuring a digital asset was not double spent. When you transact this way, you are literally asking the bank to send funds from your account to another.

Blockchain transactions are processed in an entirely different way. They begin with the sender, who holds their funds in a crypto wallet. The sender initiates payment by indicating the address they want to send funds to, and then executing the payment by signing with their private key.

Think of a private key as a secret phrase or password only you know that gives you the authority to spend the tokens in your wallet. No permission is needed to send crypto funds because the sender has 100% control over them.

The novelty of blockchain technology is that payments can be processed in a decentralized way — meaning without the need of a third party like a bank. This includes ensuring funds are not double spent. For the first time in history, by using blockchain technology, it is possible for humans to store and control their own digital assets without an intermediary.

But cryptocurrencies can be held in both custodial and non-custodial environments too, and there are pros and cons to both. Let’s examine them in detail.

A Blockchain-Based Custodial Solution

One of the most popular examples of a custodial solution in crypto is Coinbase. Coinbase allows its customers to manage a portfolio of digital currencies using their bank-like interface. In fact, one of the main draws of a service like Coinbase is that the user experience is very familiar.

It offers a standard login screen, password reset, and a customer service department if something goes wrong. New crypto users experience reduced curve with Coinbase, which makes it a popular option for those just getting started. Also, Coinbase allows its customers to link their bank accounts, allowing them to buy digital assets with funds from their bank account, or even convert their digital funds back into fiat currency like USD.

However, just like banks, the same trade-offs apply to Coinbase. Users have to give up personal information in order to verify their identity, pay transaction fees, and do not ultimately control their own assets. Not only that, all custodial entities, including Coinbase, face the danger of getting hacked; many have, resulting in an enormous loss of their customers’ funds.

A Blockchain-Based Non-Custodial Solution

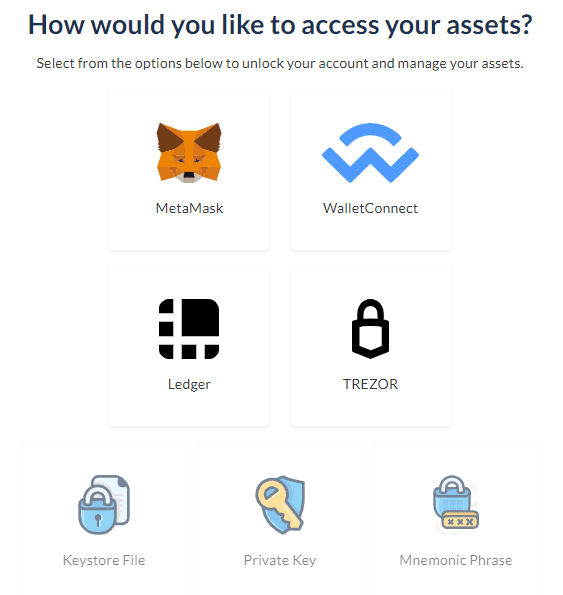

On the other end of the spectrum is MyCrypto. MyCrypto is an open-source application that enables users to create their own Ethereum wallets, send and receive ETH and other ERC-20 tokens, and generally interact with the Ethereum Blockchain more easily. MyCrypto is not a bank and therefore does not hold users’ digital assets. Instead, MyCrypto is a tool that allows a user to be their own bank.

Using a non-custodial solution like MyCrypto offers some clear benefits. Most importantly, users remain in complete control of their funds. Only they can initiate payments from their wallets; so long as they remain the sole possessor of their private keys, their funds cannot be taken from them.

Second, MyCrypto does not collect personal data. Users create wallets and wallet backups, and choose their passwords right from the website or from the downloadable client. No identifying information is needed. And third, MyCrypto does not charge usage fees.

The biggest trade-off of using non-custodial options like MyCrypto is responsibility. Blockchain tools have a learning curve, and unfortunately, mistakes can be devastating. If a user loses access to their private key or backup and password, the funds contained in their wallet are lost.

There is no account recovery or password reset. You are responsible for your own funds, for good or ill. Through carefully designed UX, MyCrypto endeavors to prevent user error, but it’s impossible to guard against every mistake imaginable.

The Best Blockchain Solution

Now that we’ve explained the pros and cons of each, which is the right one for you? This depends on a couple of factors:

1. Your confidence with blockchain technology: In many cases, a custodial option like Coinbase might be the most attractive choice to a new user, since it’s a much more familiar experience. The risk of making a catastrophic mistake while you’re still learning the ropes outweighs the inherent shortcomings of giving custody to a reputable third party. If you go this route, just make sure the company you use has a good track record, and be warned that the larger the sum you keep on an exchange, the more you stand to lose in the case of an attack.

2. Your values: Custodial options are a bit easier to use, but if you value privacy and asset control more than you value a bank-like experience, MyCrypto is the better option by far. Weigh the pros and cons of each, based on your standards.

We recommend all new users start with a custodial option until they become familiar with using cryptocurrencies. Once you are more comfortable, create an Ethereum wallet using MyCrypto (here’s a link to the client download), and send a small sum to it.

For extra security, purchase a hardware wallet like Ledger or Trezor. Both seamlessly interact with the MyCrypto client and web app, and guard against scammers looking to steal your crypto. A hardware wallet plus MyCrypto is one of the most secure ways to hold digital assets. Regardless, please remember to start slow with limited funds, so if you do make a mistake it’s not catastrophic.

Blockchain Technology gives users a revolutionary ability to control their own digital assets free from manipulation by third parties. This is a powerful, innovative evolution in personal finance, but one that comes with great responsibility. Though once you’re ready, you can be your own blockchain bank.

Thank you Matthew Carano for lending your brain and putting in the footwork on this!

We recommend reading further. Here is a great resource for learning about not only cryptocurrency, but the specifics of Ethereum, Bitcoin, and decentralized finance. Arm yourself with knowledge!